Why set up a digital lending business in Rwanda?

There is a promising future for the Rwandan digital economy and the spending habits of the Rwandans as well as stable democratic regime, ease of doing business policies and the government’s impressive drive towards technology infrastructural development to support digital businesses.

As of January 2023, Rwanda had about 5 million internet users with the country’s internet penetration rate standing at 30.5% of the total population of 13.78 million. Available data shows that Rwanda’s digital payments market is on a strong upward trend, with a total transaction value of about USD 1,417 million in 2023.

How do I set up a digital lending in Rwanda?

This digital loan method is increasingly replacing traditional offline loan application methods in Rwanda as a result of the increasing internet penetration and widespread use of mobile phones. In Rwanda, digital lenders are set up and licensed by the Bank of Rwanda (“BOR“) as Non-Deposit-Taking Financial Services Providers (“NDFSPs”), which provide loans to individuals (and, in some cases, small business owners) through online loan platforms but are not allowed to take any deposit from the public. Through these online loan platforms, individuals in Rwanda can complete an entire loan application process virtually and get loan value in their bank account without moving an inch.

The first step in the process of setting up a digital lending business in Rwanda is to incorporate a financial services company with the Rwanda Development Board (“RDB”). Thereafter, a licence in the relevant category can be obtained from the Central Bank of Rwanda, which is the apex bank and regulatory of the Rwandan financial services space. Please note that a foreign NDFSP can open up a subsidiary or branch in Rwanda. Also, a digital lending business can combine financial and non-financial business as long as the financial business covers at least 70% of the assets.

Please read here to see the requirements for incorporating a digital lending company with the RDB. YOU CAN ALSO SEE OUR PREVIOUS ARTICLE ON THE SAME SUBJECT BELOW:

What legal framework and licence categories exist in Rwanda digital lenders?

In Rwandan, digital lenders are largely regulated by the BOR’s REGULATION No. 65/04/2023 of 25/04/2023 GOVERNING NON-DEPOSIT TAKING FINANCIAL SERVICES PROVIDERS (“Regulation“). Article 5 of the Regulation states that any Applicant intending to conduct financial services as a non-deposit-taking financial services provider must obtain a licence from the Central Bank (also known as the National Bank of Rwanda or NBR). As per the Regulation, all activities and changes that include appointment of board members and management; opening, relocation and closure of the place of business; change of corporate name; acquisition. amalgamation or merger; should all be approved by NBR.

The Regulation provides for three (3) categories of NDFSPs as follows:

- Category I covers mortgage finance activities, refinancing services, and development finance institutions.

- Category II covers credit services only, Finance Lease, credit guarantee services, peer-to-peer lending, factoring business and any other financial services that may be determined by the Central Bank.

- Category III covers money lending, pawnshop, hire purchase or Buy Now Pay Later and any other financial services that may be determined by the Central Bank

- Category IV covers the following:

- This regulation accommodates Saving and Credit Association (Ibimina) that have mobilized at least Frw 500 million funds in circulation among group members;

- Buy Now and Pay Later products that charge interests are accommodated;

- Money Lenders lending to only individuals not legal entities are accommodated with capital of Frw 30 million;

- Peer to Peer Lending (crowdfunding) are accommodated;

- Pawnshops are accommodated;

- Debt councilors are accommodated;

From the above, it is clear that regardless of the mode of operation, any company can carry on the business of lending in Rwanda under any of the above categories of BOR’s licence.

Are there any special requirements to consider while incorporating a digital lending company?

1. What is the minimum share capital requirement?

Yes. The share capital requirement varies for the different categories of NDFI as follows:

Category I must be registered with a share capital of 100,000,000 RWF

Category II must be registered with a share capital of 50,000,000 RWF

Category III: A company seeking to set up as a non-deposit-taking financial institution under category 3 must be incorporated with a share capital of RWF 30,000,000.

Category IV: The share capital requirement under this category depends on the type of business. For instance, Saving and Credit Association (Ibimina) is required to have mobilized Frw 500 million funds; and Money Lenders lending to only individuals not legal entities are accommodated with capital of Frw 30 million.

See our previous article on How to Set up a Digital Lending Company in Lagos below:

2. Is an applicant for digital lending licence required to deposit the share capital with the National Bank of Rwanda?

Upon incorporating the company with the RDB, the promoters are required to immediately open a bank account for the company with a commercial bank in Rwanda. Before applying for the licence, the promoters must deposit the equivalent of the prescribed minimum share capital in the company’s bank account in Rwanda and furnish the central bank with the evidence of such deposit (e.g. bank statement).

Take note that these funds should be domiciled in the bank account of the company and not with the central bank. However, the applicant must show compliance with this requirement by attaching proof that the minimum share capital is domiciled in the bank account of the company. During operations of the company, the deposited funds must not go below the minimum share capital value. If this happens, the Central Bank will request the company to inject more funds into the account to maintain the required minimum share capital.

The Regulation further allows a natural or legal person to own shares in NDFSPs up to the tune of 100%. Acquisition and transfer of significant shareholding should be approved by NBR. A single individual or corporate body can be the sole shareholder of a digital lending company in Rwanda by holding all 100% of the shares of the company.

3. What is the corporate governance requirement?

In relation to corporate governance, the Regulation provides the structure and composition of the board of directors and management for categories I and II (which are related to digital lending). Outsourcing is allowed provided it does not lead to conflict of interest, however, outsourcing material functions or activities requires NBR’s approval.

The board of a digital lending company under Categories I and II of the Non-Deposit Taking Financial Service Provider must comprise of a minimum of three (3) directors with at least two (2) of them serving in a non-executive capacity.

Please note that directors of a digital lender must have relevant knowledge and qualifications in financial service or related fields. The Regulation is silent as to whether this number of directors and their industry knowledge, qualification and experience apply to all categories or only categories I and II. However, it is advisable that every digital company should be set up with a minimum of three directors regardless of the category.

A board member may serve on the board of more than one financial service provider. However, he or she must disclose this fact to the Central Bank and give an undertaking that the several positions held will not amount to a conflict of interest.

Where a director of the company is based outside of Rwanda, he or she shall show the Central Bank how he or she will fulfill the duties of directorship.

What is the procedure for processing a digital licence in Rwanda is the application submitted?

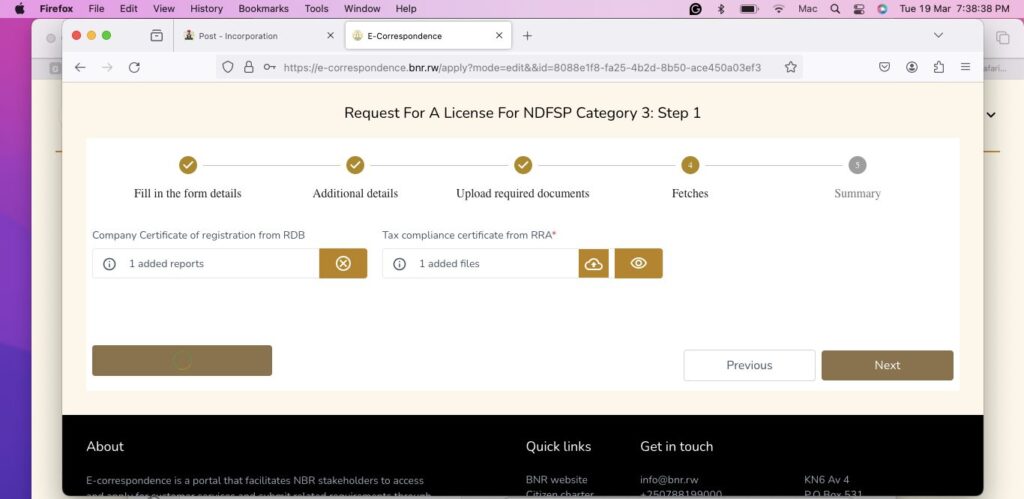

1. The first stage is to incorporate a digital lending company with the RDB. Incorporation can be completed without any provisional approval from the Central Bank though must meet the minimum requirements in terms of the prescribed share capital and minimum number of directors. After the incorporation, the next step would be to immediately set up an account in the name of the company on the National Bank of Rwanda’s E-Correspondence portal. In setting up the account, the email address and phone number of the company (or of a shareholder) will be required. This is necessary to enable the applicant receive the One Time Password with which the applicant will use in completing the account setup process.

2. After successfully setting up an account on the E-Correspondence portal, an applicant can commence the licence process from the dashboard by select the relevant licensing category.

3. Fill in the company’s address and click on the save and continue icon. Using the save and continue icon will enable the Applicant come back and complete the process if the process cannot be completed at once.

4. Next is to fill in the details of the shareholders, directors and senior management staff. The details to be filled are basically the name, address, phone numbers, position, to enable you fill in the details of the shareholders, directors, senior management of the company. While filling the details of each director, shareholder and senior management staff, the applicant will also be required to upload their CVs, criminal record certificate, tax clearance certificate, filled and notarized personality declaration forms, notarized degree, reference letters and credit reference report.

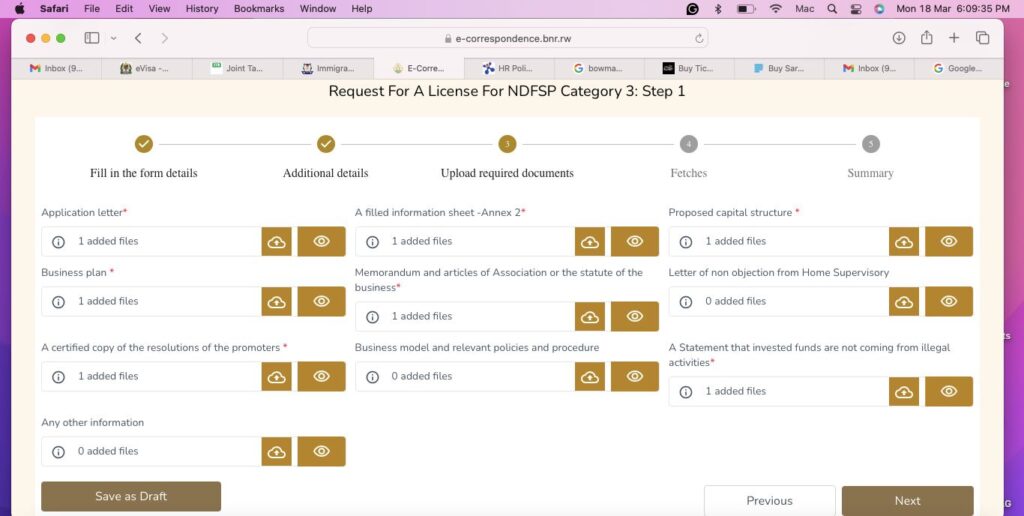

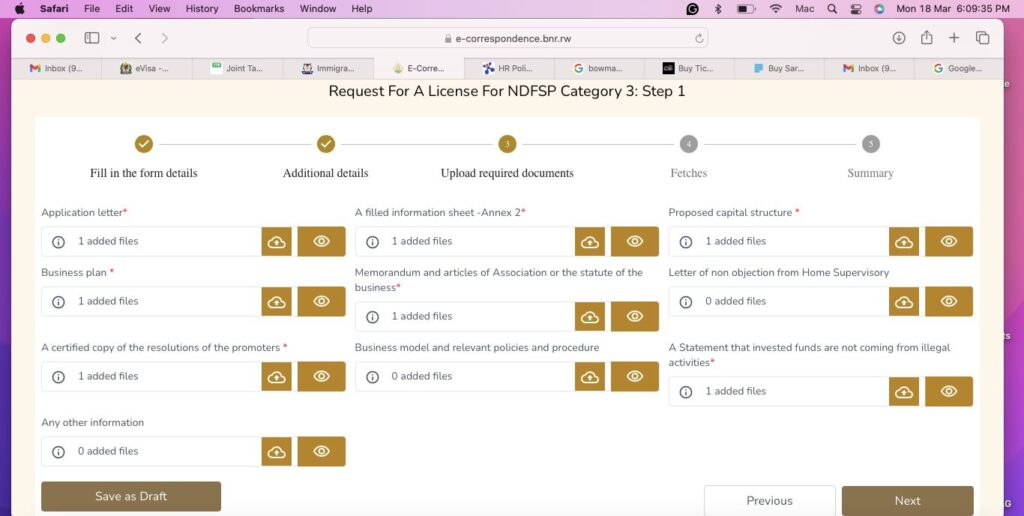

5. The next page will allow the applicant upload all the required documents which comprises of the following documents:

- Filled and notarised company information sheet

- Certificate of incorporation (by inputting the company code in the e-correspondence portal, this certificate will be automatically fetched from the RDB.

- The memorandum and articles of association of the company.

- Company’s tax compliance certificate

- Statement of asset and liabilities

- A feasibility report for the proposed business.

- Proof of the deposit of the minimum paid-up capital in the bank account of the applicant.

- Proof of source of capital

- Proof of payment of the non-refundable application fee.

- A certified copy of the resolution of the promoters to establish a non-deposit taking financial service provider

- A statement that the invested funds are not coming from illegal activities

- Board Charter

- Business model and relevant policies such as:

- Administration and human resource policy

- Investment policy

- Accounting and finance policy

- Risk management framework

- Any other strategic document that deems necessary.

Please note that the above mandatory documents must meet the required standards of the NBR for them to be approved. Otherwise, they will be rejected during the first review by the licensing authority.

How is the payment of the application fee made?

Upon uploading and submitting all of the above documents on the E-Correspondence portal, an application reference number will be generated for the applicant. The applicant is required to use the application reference number to make payment for the application fee to the National Bank of Rwanda. At the point of payment, the applicant must ensure that the reason for payment is clearly stated along with the application reference number. This will enable the NBR to connect the payment to the particular application as several applications are submitted regularly via the same channel.

Is there a timeframe within which the application fee must be paid?

It is advised that the payment of application fee for digital lending licence must be made within a period of three (3) days from the date of submission of the application otherwise the said application may be marked as “cancelled”. Where the payment is made and confirmed within the required period, the application will be moved to “under review”.

How long does it take for the National Bank of Rwanda to review the application after submission?

From our experience, it takes a period between two (2) weeks to one (1) month from the date of submission of the application for the NBR to revert with comments and observations about the application or request for outstanding documents. Where there are outstanding documents to be furnished, the applicant will be notified by email and must provide them within a period of one (1) month from the date of request.

Does the central bank grant a provisional approval?

Where the NBR is satisfied that the licensing requirements have been largely provided in compliance with its Regulation, the apex bank may issue a non-objection notice which is the equivalent of provisional approval to enable the company to commence operations pending when all licensing requirements will have been provided or met.

Please note that the notice of non-objection can only be used for a period not exceeding 12 months. Where this period is exceeded without getting the full license, the central bank may decide to extend or revoke the non-objection or outrightly cancel the application.

Will the NBR conduct an onsite inspection of the applicant’s place of business?

Yes. The physical office inspection of a digital lender is necessary to confirm the applicant’s place of business and to ensure that the applicant complies with the provisions of the regulation and other frameworks put in place by the central bank. Please note that the cost relating to the supervisory function of the Central Bank shall be borne by the applicant.

The report of the onsite inspection of a digital lender is communicated to the board of directors of the applicant. Where necessary, the central bank may make recommendations to the company in the report. Also, the report shall equally indicate the deadline within which the recommendations must be implemented.

Where the central bank is satisfied that all licensing requirements have been met, the central bank may then issue a certificate to allow full digital lending operations in Rwanda.

Please note that the issuance of a non-objection may not be necessary if the central bank is satisfied with all the documents and requirements provided upon first application. Also note that the central bank may or may not conduct a physical office inspection. This is totally at the bank’s discretion.

Are there any other regulatory registrations required for a digital lending company?

The Data Protection and Privacy Law (“DPP Law”) provides for the protection of personal data and privacy rights of people in Rwanda. The DPP Law regulates the processing of customer’s data and imposes obligations and penalties on data controllers and processors who harm or violate privacy rights of any data subject.

Further to the above, the law also provides that any person who intends to be a data controller or processor must be registered with the supervisory authority, i.e. the Data Protection Office (“DPO”). A digital lending company by the nature of its operations is classified as a data processor, hence, must register with the DPO in order to operate in Rwanda without any interruptions based on regulatory compliance.

What are the requirements for registration with the DPO as a data processor

To register with the DPO, a digital lending company must provide the following :

- Identity of the designated single point of contact;

- Identity and address of the representative of the digital lending company. Even though this is not a requirement, it is advised that the representative of the company should be a person who understands and has knowledge of personal data privacy and protection matters;

- The purpose of the processing of the personal data;

- The categories or recipient to whom the data controller or data processor intends to disclose the personal data;

- The country (if any) to which the applicant intends to directly or indirectly transfer the personal data;

- Risks in the processing of personal data and measures to prevent such risks and personal data

The supervisory authority may require additional requirements to be met by the applicant to complete the registration process.

Where the supervisory authority is satisfied that the applicant has met with all the requirements, the applicant will be issued a certificate of data protection compliance.

Are there any penalties for failure of digital lenders to register with the DPO before commencing operations?

As a data processor or controller, registration of a digital lender with the DPO is mandatory. Where a digital lending company is found to be processing the personal data of its customers without the required registration, or with an already expired licence, administrative sanctions may be imposed.

Please note that the penalty for individual’s infraction is a fine in the sum of 2,000,000 RWF (Two Million Rwandan Francs) but not more than 5,000,000 RWF (Five Million Rwandan Francs). Where the defaulter is an entity, the penalty is a forfeiture of five per cent (5%) of the company’s global turnover for the preceding financial year.

In addition to penalties provided for in the DPP Law, the court, in all cases, may order the seizure or confiscation of items used in the commission of any of the offences provided for in the DPP Law and the proceeds gained. The court may also order permanent or temporary closure of the legal entity or body, or the premises in which any of the offences provided for under the DPP Law was committed.