1. Who is a director under Nigerian law?

Under Nigerian law, there are three (3) types of directors: the executive directors, the non-executive directors and the shadow directors.

Executive directors are those directors who are involved in the day-to-day management of the company’s business usually with departmental positions such as: Executive Director, Finance or Executive Director, Human Capital or Executive Director, Risk & Compliance, etc. A Managing Director of a company may also fall under this category of directors, though, he/she may also be named in the company’s register of directors as a non-executive director (which means he/she has double positions).

The non-executive directors are persons merely appointed to the board of directors and named in the records of the Corporate Affairs Commission (“CAC”) whose main mandate is to provide oversight, sectorial expertise, knowledge and new skills to the company’s management team. The non-executive directors are not involved in the company’s daily business operations but participate in the company’s activities only when the board meets.

The third category of directors, known as shadow directors, is a directorship which arises based on the presumption of law. It is a position imposed by Section 270(1) of the Companies and Allied Matters Act, 2020 (“CAMA”). By the said provision, any person on whose instructions or directions, the directors of a company are accustomed to act will be deemed to be a shadow director unless such person is doing so in a professional capacity.

Please note that all matters relating to appointment and removal of executive directors are contractual matters between the company and the affected executive directors whilst those of non-executive directors may be regulated by the CAMA where no contract exists.

2. What is the minimum number of directors that a company must have?

A small company may have at least one (1) director while any other private company limited by shares (which is not a small company) must have at least two (2) directors.

A public company must have not less than three (3) independent directors whose relatives have not within the preceding two (2) years:

(a) was not an employee of the company,

(b) did not

(i) make to or receive payment of more than N20 Million from the company or

(ii) own more than 30% share or other ownership interest, directly or indirectly in any entity that made to or received more than N20 Million, or

(iii) act as a partner, director or officer of a partnership or company that made to or received N20 Million,

(c) did not own directly or indirectly more than 30% of the shares of any type of or class of the company, and

(d) was not engaged directly or indirectly as an auditor of the company.

Where the number of directors goes below the minimum, then the company must appoint new director(s) not later than one (1) month or stop business operation.

Please note that there are some regulated businesses which require different numbers of directors, for example, companies seeking to operate in the financial sector with a licence of the Central Bank of Nigeria is required to have not less than five (5) directors whilst a money lender company seeking to operate in Lagos must have at least two (2) adult directors.

3. Can a person be appointed as director for life or is there a tenure for a director?

A person can be appointed director for life in accordance with Section 281 of CAMA provided that he can be removed as director in accordance with the provisions of Section 288 of CAMA. Where a person is appointed as director for life, it is important to include this appointment in the company’s article of association.

However, Section 285(1) of CAMA provides that where there is no appointment for life, all the directors shall retire at the first annual general meeting(“AGM”) of the company. At the AGM in every subsequent year, one-third of the directors (or if their number is not 3 or multiple of 3, then the number nearest to one-third) shall retire from office.

In considering the order of retirement, the longest serving directors are to retire first but as between those persons who are appointed on the same date, those to retire are to be determined by lot unless they otherwise agree amongst themselves.

Pursuant to Section 285(3) of CAMA, a retiring director is deemed to be reelected unless another person is elected or appointed in his stead or the members expressly resolved not to fill a vacancy created by the automatic retirement of directors or where a resolution for such re-election of a director has been put to the meeting and lost.

4. How is the remuneration of directors determined and what are the ranges in Nigeria?

A company is not bound to pay remuneration to non-executive directors in Nigeria but where the company agrees to pay, the payment shall be out of the fund of the company and may be recovered as debt against the company. Section 293 allows the company in general meeting to determine the directors’ remuneration and such remuneration is deemed to accrue from day-to-day.

The company and the individual director are free to negotiate the fees for directorship and the amount can be fixed by the articles of association. In Nigeria, the annual fees of non-executive directors usually range between $10,000 to $20,000, depending on the nature of business, size of investment, risk level of regulatory reporting and compliance obligations. Where directors’ remuneration is fixed by a company’s articles, then the company can only alter it by a special resolution. See Section 293 (3) of CAMA.

Please note that directors may also be paid travelling, hotel and permissible expenses properly incurred by them in attending and returning from meetings of the directors, committee of the directors, general meetings of the company or in connection with the business of the company. A director who receives more money than he is entitled to, is guilty of misfeasance and is accountable to the company for such money under Section 293(6) of CAMA.

5. What types of payments to directors are prohibited under Nigerian law?

There are certain payments to directors that are prohibited in Nigeria. Whenever these prohibited payments are made, the directors who received the payments are deemed to have received such in trust for the company. The following are some of the prohibited payments:

i. Loan or Guaranty to Directors Without Members’ Approval: Section 296 of CAMA prohibits the grant of loan or guarantee for a loan by a company to its directors or directors of its holding company unless such payment or guarantee is in respect of expenditure incurred in his duties to the company or the company is a money lending business and with prior approval of the company at the AGM and the loan shall be repaid or the liability under the guarantee shall be discharged before the next AGM. Failure to obtain the right approval will expose all directors who approve the loan or guarantee to indemnify the company if any loss arises from such loan or guarantee.

ii. Severance or Retirement Benefits Without Members’ Approval: Payment to directors as compensation for loss of office or retirement from office is unlawful unless the particulars of the proposed payment and the amount have been disclosed to members of the company and the proposal is approved by the company. See Sections 297 and 298 of CAMA.

6. Are director’s payments subject to taxation?

Yes. Section 295 of CAMA prohibits tax-free payments to directors. It is unlawful for a company to insert any provision in a company’s articles of association or contract of appointment to allow directors to receive payment of remuneration without paying applicable income tax or withholding tax.

In Nigeria, directors’ fees are subject to 10% withholding tax. If there are other payments such as dividends for directors’ shares, the company is required to deduct and remit 10% of the dividend amount as withholding tax.

7. How does a company appoint its first directors in Nigeria?

The appointment of a company’s first director(s) is made during incorporation of the company by naming the appointed persons in the online application via CAC e-registration portal form and the listed persons are deemed to be approved by the subscribers of the company’s memorandum of association.

The process of appointing first directors is straight-forward. Apart from the general details of the directors, including his means of identification and electronic signature, the appointment of a director at incorporation is seamless and requires no written consent of the appointed persons or written resolution of the members. The submission of the foregoing information and documents is deemed as implied consent to be so appointed.

8. When can a company appoint additional directors after company registration?

All kinds of post-incorporation filings, including appointment of additional directors, can be done from 48 hours after the date of registration of a company.

The need for appointing new directors may arise where the other directors of a company are dead or the office of a director is vacated in accordance with the law or where the company desires to change or expand its business into some regulated sectors which require a higher number of directors. For instance, a money lender company in Lagos must have at least two directors whilst a financial service company licensed by the Central Bank of Nigeria is usually required to have a minimum of five directors.

Specifically, the office of a director shall be deemed vacated according to Section 284(1) of CAMA (following which additional director may be appointed) if:

i. The director ceases to be a director by reason of share disqualification (where his directorship is contingent upon his shareholding) as provided under Section 277 of CAMA;

ii. The director becomes bankrupt or makes any arrangement or compromise with his creditors;

iii. The director becomes prohibited from being a director by any court order declaring him to be a fraudulent person and restraining him from holding a directorship position in accordance with Sections 280 – 281 of CAMA;

iv. The director becomes of unsound mind; or

v. The director resigns his office by notice in writing to the company.

9. What are the requirements for appointing a director of an existing company?

The appointment of directors to the board of an existing company differs from that of a company at incorporation stage in that the latter requires some board or shareholders’ resolution whereas the former does not.

The particulars of directors required to be registered in a company’s register of directors are the same which will be required to file their appointment with CAC. They are as follows:

i. Full names of director;

ii. Contact and home addresses of director including his/her Nationality, State and Local Government;

iii. Date of birth;

iv. Telephone number and email address;

v. Acceptance letter signed by director showing consent to be appointed as director;

vi. Board Resolution;

vii. Government-issued means of identity; and

viii. Residence permit (only for non-Nigerian directors who are resident in Nigeria or submit a Nigerian address as his or her contact address).

Please note that the appointment of additional directors is now completed online using the CAC portal system.

10. Is there any mandatory regulatory filing for appointment or removal of director in Nigeria?

Yes. Notice of appointment or removal of director shall be filed with the CAC within fifteen (15) days of the appointment or removal in accordance with Section 262(1) of CAMA though Section 321 imposes a duty on a company to notify CAC within fourteen (14) days of the appointment or cessation of a person as a director. It is the post-appointment filing at the CAC that formalizes or completes the appointment process.

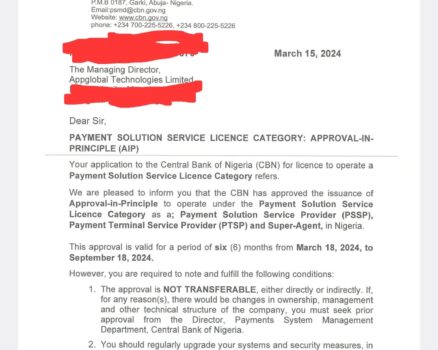

Also, in some regulated businesses such as financial services companies licensed by the CBN, different considerations apply. A CBN-regulated company seeking to appoint new directors must first obtain prior approval of the CBN on the nominee(s) before finalizing such appointment or filing any notice of appointment at the CAC.

With regard to removal of directors of CBN-regulated companies, the company may proceed to remove but must immediately thereafter notify the CBN of such removal, usually within fourteen (14) days.

11. What are the grounds for disqualifying a person from becoming a director in Nigeria?

There are some sector-specific requirements for determining who qualifies to be appointed as directors in regulated businesses. However, the CAMA provides some basic general qualifications for directorship appointment.

By virtue of Section 283 of the CAMA, the following persons are disqualified from being a director in Nigeria:

i. An infant, that is, a person under the age of 18 years;

ii. A lunatic or person of unsound mind;

iii. A person who has been disqualified under Sections 279, 280 and 284 of CAMA (it is unclear if the draftsman of law intended a person who resigns as director under Section 284(1)€ to be disqualified from further appointment);

iv. A person who has been suspended or removed from office of director under Section 288 of CAMA; and

v. A corporation other than its representative appointed to the board for a given term.

vi. A person shall not be a director in more than five (5) public companies. Where this is so, he shall resign at the next AGM from all but five (5) of the companies (Section 307(2) of CAMA).

Please note that a disqualified director, upon the occurrence of the event leading to his disqualification, ceases to be entitled to receive notice of board meetings, cannot attend directors’ meeting or perform any of the functions or responsibilities of a director under CAMA.

12. What is the procedure for removing a director of a company in Nigeria?

Removal of directors is the prerogative of the members at the company’s general meeting or extra general meeting. The Board of Directors may however suspend a director pending the final removal of the director by the members.

Section 288 (1) of CAMA provides that “A company may by ordinary resolution remove a director before the expiration of his period of office, notwithstanding anything in its articles or in any agreement between the company and him.” The foregoing provision is not absolute because Section 288(6) of CAMA permits the removal of a director in accordance with a power which may exist outside the provision of Section 288(1) of CAMA.

It therefore means that a director can be removed in three (3) ways:

(a) by ordinary resolution, notwithstanding the provisions of the Articles of Association or any agreement between the director and the company;

(b) by special resolution given at a members’ meeting of which special notice has been given; and

(c) In accordance with any power to remove a director which may exists outside the provision of Section 288 of CAMA.

From the provision, it means members of company are empowered to remove a director when they desire.

The procedure for removing a director under Section 288 of CAMA is highlighted below:

i. Issuance of Special Notice to Remove (and Appoint a New Director): Issue a Special Notice (of not less than 28 days) for the removal of a named person as director (with or without a named person to be appointed instead of the director so removed) and send a copy to the affected director inviting him to make a written representation to the board or a verbal representation at the meeting where the resolution for his removal will be passed.

ii. Right of Fair Hearing: A director sought to be removed is entitled under Section 288 (3) (a) and (b) of CAMA to make a written representation (not exceeding a reasonable length) and request that a copy be sent to the members of the Company. If the director submits a written representation (usually not more than 1,000 words, see S.260 of CAMA) is submitted to the company secretary timely in response to any allegation against him, the company is required to circulate the written representation amongst the shareholders or, on the director’s request, cause the representation to be read out at the meeting. Please note that a court order may be obtained to restrain the company from circulating or reading out a director’s representation, if doing so will amount to abuse or needless publicity of defamatory matter and award costs against the company and order the company to pay such cost, notwithstanding that he is not a party to the application before the court.

iii. Passing of Special Resolution to Remove a Director: After the affected director has made a representation or his written representation has been read out at the meeting, the members (voting in person or by proxy) are required to pass a special resolution to remove the director. In practice, the declaration of the chairman that the special resolution is carried is conclusive evidence without proof of the three-fourth of the members voted to remove the director unless a poll is demanded. Section 258 (2) of CAMA provides that a resolution is special when it has been passed by at least three-fourths of the votes cast by members of the company (voting in person or by proxy) at the general meeting of which 21 days’ notice, specifying the intention to propose the resolution as a special resolution has been duly given. Provided that members with 95% of the company’s shares or voting right may propose and pass a special resolution at a meeting of which less than 21 days’ Notice has been given.

iv. Filling a Vacancy Created by a Removed Director: As provided in Section 288 (4) of CAMA, a vacancy created by the removal of a director may be filled at the same members’ meeting after the special resolution for the removal of the director has been passed. The mode of voting on appointment of directors is provided in Section 287(1) of CAMA. If there is no appointment of a new director by the members, the board of directors may thereafter appoint any person to fill the position as a casual vacancy. In order to determine the retirement of the new director, the date of appointment shall be the date on which the removed director was appointed, not the date of appointing the new director to fill the casual vacancy.

13. What is the consequence of a director who has been removed without following due process?

By virtue of Section 288(6) of CAMA, non-compliance with the procedure for removal of director entitles the aggrieved director to compensation or damages. It is to be noted that the office of a director is a statutorily protected office and it is very much possible for a director removed without due process to obtain an order of court reinstating him back to the office if he has not been properly removed.

14. Is a removal of director invalid simply because notice of meeting does not state that removal or appointment of director will take place?

No.

In U.O.O. (Nig.) Ltd. v. Mr. Maribe Okafor (2020) 11 NWLR (Pt. 1736) 409 the Supreme Court opined that the removal, election, appointment of directors etc., constitute some of the ordinary businesses of an annual general meeting (“AGM”) and that, so long as notices of the AGM were duly issued and served on all the members/shareholders, it is presumed that the removal, election and appointment of directors will inexorably form an integral part of the ordinary business to be transacted.

According to the apex court, any omission or error as to the general nature (agenda) of the business of an AGM shall not invalidate the meeting including the removal of any director at such meeting. Justice Peter Odili, JSC at page 453 of the report held as follows:

“It follows that any director (like Nze Edozie Uche Okafor in the instant case) who received due notice of the AGM, did not require any other notice to indicate that the removal, election or appointment of directors would likely take place at the AGM. This is because, by virtue of section 218(2) of CAMA, a statement that, “the purpose is to transact the ordinary business of an AGM” shall be deemed to be a sufficient specification that the business is for election of directors and by implication, Chairman of the Board and Directors.”

15. Is there any personal liability for being a director of a company in Nigeria?

Yes. A company may also provide in its memorandum of association or by special resolution that the liability of a director is unlimited (See Sections 314 and 315 of the CAMA). Apart from the foregoing, the CAMA provides for personal liability of a director who acts outside the scope of his authority, who misappropriates the company’s money or other officer’s money, commits fraud, consents to payment of dividends from the company’s shareholders’ funds,

Under Section 862 of CAMA, if any person (including a director) in any company’s return, report, certificate, balance sheet, or other document required by law wilfully makes a statement which is false in any material particular knowing it to be false, he commits an offence and is liable, on conviction, to imprisonment for a term of two years; and in the case of a company, to fine as the Court deems fit for every day the default continues.

Also, every director of a company which makes a statement in its annual returns which is false in any material particular shall in respect of each year of any such returns be liable to a penalty prescribed in the Commission’s regulations notwithstanding any provisions of any other law imposing penalties in respect of perjury in force in Nigeria.

In Nigeria, tax authorities hold directors personally liable for the evasion of tax by the company. See Section 37 of the Companies Income Tax Act ad Section 49 of the Federal Inland Revenue Service (Establishment) Act (as amended by the Finance Act 2020 and 2021.

The CAC holds directors personally liable for any misstatement in the financial statements of a company. It is not an excuse that a director was not properly appointed or did not participate in a board decision. By Section 286 of the CAMA, the acts of a director (by extension the board), manager, or secretary are valid notwithstanding any defect that may afterwards be discovered in his appointment or qualification.

16. What are the statutory duties of a director in Nigeria?

Director’s duties in a Nigerian company are almost the same around the world. Below is a list of duties of a director:

(i) Duty to give notice to the company of such matters relating to himself relating to his shares or debentures of the company or its subsidiary, holding company or a subsidiary of the company’s holding company (Sections 301 & 302 of CAMA);

(ii) Duty to disclose his direct or indirect interest in any contract, transaction or proposed transaction to the board of directors in writing (Section 303 of CAMA);

(iii) A fiduciary duty to the company to act in good faith whenever he acts as agent of the company or a particular shareholder or where the interest of the company needs protection (Section 305(2) & (3) of CAMA);

(iv.) Duty not to fetter his discretion as a director to vote in a particular way (Section 305(6) of CAMA);

(v.) Duty not to delegate his director’s powers in such a way and manner as may amount to an abdication of duty (Section 305(7) of CAMA);

(vi.) Duty of director to avoid conflict of duties and interests (Section 306 of CAMA);

(vii.) Duty of director to take reasonable care and skill and to be responsible for the action of the board in which he participated, and his absence from the board deliberations, unless justified, does not excuse any director from responsibility (Section 308(3) of CAMA);

(viii.) Duty as trustees of company’s money, properties and their powers and to account and to exercise all their powers honestly and not in sectional interests (Section 309 of CAMA);

(ix.) Duty not to make secret benefits, accept bribes, gift, or commission either in cash or kind from any person or a share in the profit of that person transacting with the company in order to introduce the company to such person (Section 313 of CAMA);