Any Nigerian company that has not filed its annual returns as and when due should be worried about being delisted by the Corporate Affairs Commission (“CAC”) in addition to other regulatory sanctions that may be imposed on its directors and shareholders.

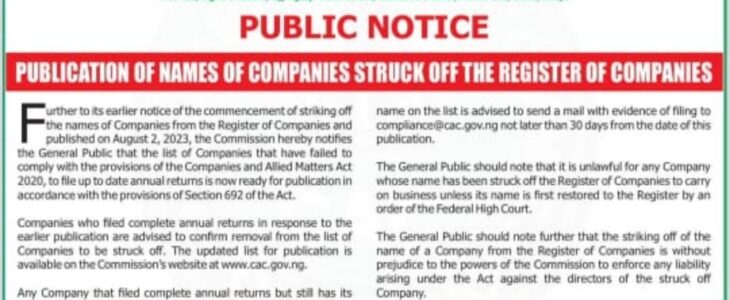

The CAC has published an updated list of 91,843 Nigerian companies to be delisted from the Companies Register for failure to file annual returns and update their records. The list contains the name, registration number (i.e. RC No.) and date of registration of the affected companies which were registered on various dates.

To check if your company is on the list of companies to be delisted, click the link below: https://www.cac.gov.ng/wp-content/uploads/2023/12/STRIKE-OFF-LIST-UPDATED-NOV-23-2023.pdf

The CAC’s power to strike off of companies from the Register of Companies is derived under Section 692 (3) of the Companies and Allied Matters Act 2020 (“CAMA”). There are grounds upon which CAC can strike off a company’s name from its Register.

The CAC has the power to strike off the name of a company from the Companies Register where it has reasonable cause to believe that the company is not carrying on business or has not been in operation for ten (10) years or has not complied with the provisions of CAMA for a consecutive period of ten (10) years.

Please note that prompt and up-to-date filing of a company’s mandatory annual returns is one way to inform CAC that a company is in operation. To learn more about Annual Returns, see our previous article below:

Are there other liability to the directors and shareholders? Yes. Notwithstanding the striking-off of a company from the Companies Register, the liability, if any, of the director(s), managing officer(s), and member(s) of the company shall continue and may be enforced as if the company has not been struck off.

Once a company’s name is struck off, a company can be relisted by a court order by filing an application to the court any time before the expiration of ten (10) years from the date of publication of the list of struck-off companies.

For companies that have proof of filing all annual returns but still appear on the list of delisted companies, they have up to thirty (30) days from the date of publication of the updated list to appeal to CAC for rectification.

At Koriat & Co., we are available to assist companies with filing of their annual returns and other post-incorporation filings. If you require assistance in filing annual returns or other post-incorporation filings, please contact us via admin@koriatlaw.com or 09067842241.