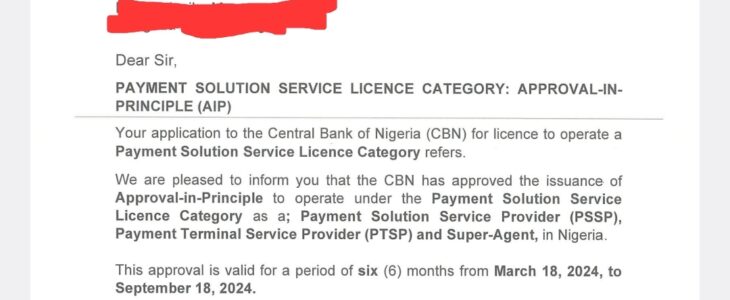

The Central Bank of Nigeria (“CBN”) has granted an Approval-In-Principle (“AIP“) to Appglobal Technologies Limited, a fintech company in Nigeria, to operate three types of payment services or businesses under the Payment Solutions Service Licence Category. The CBN is the apex regulator of the Nigeria’s financial services space and licensing institution for all financial institutions with nationwide operation in the country. Appglobal is a financial technology company in Nigeria poised to solving the nation’s challenges of inclusive financial services through innovative payment products and services to its wide range of individual and corporate customers.

After a rigorous procedure, the CBN has finally granted a provisional approval to Appglobal to provide payment products and services under the following payment licence categories:

- To operate as a Payment Solutions Service Provider (“PSSP“) company, with permission to undertake payment processing gateway and portals, payment solution/application development, merchant services aggregation and collections;

- To render all permissible services as a Payment Terminal Solutions Provider (“PTSP“): The PTSP licence permits Point of Sale (“PoS”) Terminal deployment and services, PoS Terminal ownership, PTAD, Merchant/agent training and support whilst the Super Agent licence permits agent recruitment and other activities as specified in the Regulatory Framework for Licensing Super Agents in Nigeria; and

- To undertake agency banking services as a Super Agent in Nigeria.

It is important to note that none of the above licences permits its holder to either directly or indirectly hold customers’ funds or operate digital wallets. In order for a payment company to be able to hold customers’ funds or create and manage digital wallets, such company must seek and obtain a Mobile Money Operator’s licence from the CBN.

With this CBN’s approval, Appglobal will be able to build its payment processing gateway portals, deploy its customized payment terminals, create its network of merchants across the country, provide them with payment infrastructure platform and technology tools for inclusive financial products and services especially in the rural and unbanked areas of Nigeria.

Please read more about how to set up PSSP, PTSP and Super Agent companies in Nigeria and their permissible business activities in our previous articles below:

YOU CAN READ MORE BELOW ON OUR PREVIOUS ARTICLES ON PAYMENT LICENCES IN NIGERIA: